Table Of Content

- Does Debt Consolidation Hurt Your Credit?

- Don’t close older credit lines after paying them off

- Personal loans & lines

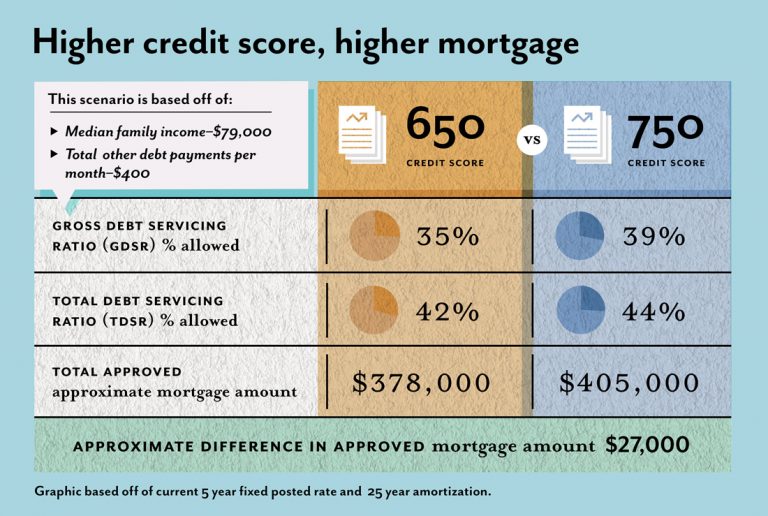

- Will I get a better deal on a mortgage with a higher credit score?

- Think About More Than Just the Loan Terms

- Overview of credit scores and mortgages for all Credit Karma members with a mortgage

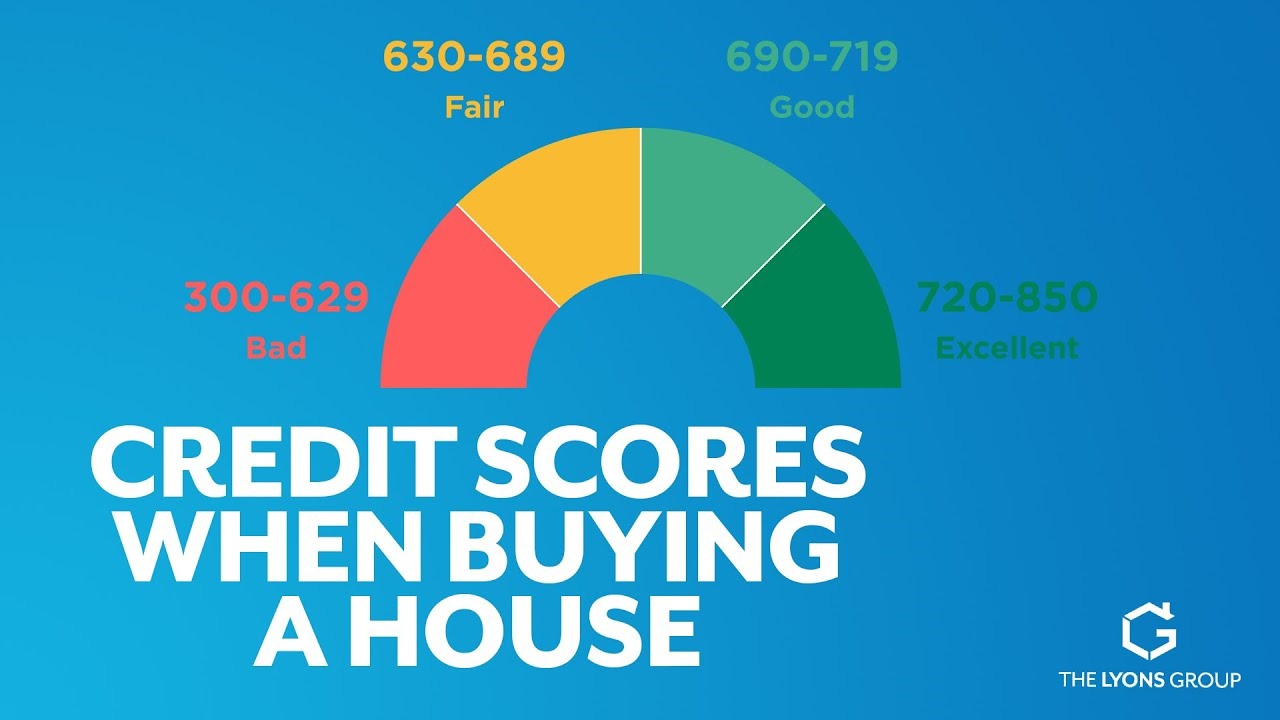

You could pay down your credit card balances to reduce your credit utilization rate. Also, avoid applying for any new forms of credit during the months leading up to a mortgage application. Department of Agriculture, USDA loans are designed for applicants who have a low or moderate income and don’t meet conventional mortgage requirements. The funding from this type of loan must be used to buy a house in an eligible rural area that will be the applicant’s primary residence. You’ll generally need a credit score of 620 or better to qualify for a fixed-rate conforming loan while ARMs typically require a score of 640 or higher. If you’re looking for a jumbo loan, you’ll usually need a score of at least 700 to get approved.

Does Debt Consolidation Hurt Your Credit?

Your credit score will also impact the interest rates and terms you’re offered, which can make a big difference in your out-of-pocket cost over the life of a loan. This is because a higher FICO Score signals to lenders that your credit risk is lower — meaning you’re less likely to fall behind on your credit obligations in the near future. So in general, the higher your credit score, the better your rate will be. Your credit report is an essential part of understanding your credit score because it details your credit history.

Don’t close older credit lines after paying them off

Your credit score is one of the most significant factors behind the mortgage rates you’re offered. In general, borrowers with higher credit scores are seen as less of a risk by lenders, which results in lower rates for those with good to excellent credit scores. If you have a lower credit score or don’t have enough cash saved for a down payment, you might consider an FHA loan. FHA loans are insured by the Federal Housing Administration (FHA). The minimum credit score for an FHA loan is 580 if you make a 3.5% down payment. If you have a credit score between 500 and 579, you’ll be required to make a down payment that’s 10% of the home’s purchase price.

Personal loans & lines

If you’re also looking for a way to improve your credit score and seeking mortgage assistance, we have something special for you. When purchasing a home, the most crucial thing is your credit score. Simply put, a high credit score will make the mortgage payment and interest low. You can always check your score and track your profile with the help of a platform specifically designed for this, like Rocket Homes. A sister to Rocket Mortgage, they will give you timely updates every week.

You can access free copies of your credit reports every week at AnnualCreditReport.com. Many banks — including Citi, Amex and Bank of America — offer access to a free FICO Score to qualifying customers. Unlike with FHA loans, the USDA doesn’t have a specific credit score requirement for a USDA mortgage. However, private lenders that offer these loans typically set their own eligibility criteria. Most of these lenders require a credit score of at least 640 to get approved. You could also consider a USDA loan if you plan to live in a qualified suburban or rural area and have an income that falls below 115% of the area’s median income.

Think About More Than Just the Loan Terms

Average Mortgage Interest Rates: Mortgage Rates by Credit Score, Year, and Loan Type - Business Insider

Average Mortgage Interest Rates: Mortgage Rates by Credit Score, Year, and Loan Type.

Posted: Thu, 18 Apr 2024 07:00:00 GMT [source]

Conventional loan financing is typically best for borrowers with good or excellent credit because they require a higher credit score than government-backed loans. The credit score you’ll need to get approved varies depending on the amount of your down payment. For borrowers with credit scores of 580 and higher, only a 3.5% down payment is required. You could also qualify with a score as low as 500, though you’ll have to put at least 10% down. Department of Veterans Affairs (VA) and backed by the federal government.

USDA Loans Minimum Credit Score: 580

Here’s how much you’d pay at the current rates (as of January 2024) for each credit score range. These examples are based on national averages for a 30-year fixed mortgage loan of $300,000. Your credit score will affect the interest rate you get when refinancing your house. Consumers with higher credit scores end up with lower interest rates. Lenders view high-credit borrowers as less risky and offer them more competitive rates. Anyone can experience financial difficulties, so don’t worry if your credit report has a few blemishes.

The requirements vary for each lender, but you must provide your employment history, copies of your federal tax returns over the past two years, W-2 forms and additional information. Some loan providers give VA loans to homeowners with debt-to-income ratios as high as 41%. USDA loans were created to help households with very low to moderate incomes purchase safe and affordable homes in rural areas. If you’re seeking to buy a home in a rural area, you may qualify, but if you’re house hunting in a metropolitan area it’s unlikely to meet USDA loan requirements. You can visit the USDA’s website and enter an address to find out if a particular property qualifies for a USDA loan.

Overview of credit scores and mortgages for all Credit Karma members with a mortgage

To calculate this, divide the amount of debt into the amount of available credit. If you have $10,000 in debt and $20,000 in available credit, for instance, your credit utilization ratio is 50 percent. Keep in mind that credit requirements vary from lender to lender.

The Experian Smart Money™ Digital Checking Account and Debit Card helps you build credit without the debtØ—and with $0 monthly fees¶. This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. To qualify, you must be an eligible member or veteran of the U.S. armed forces, a member or veteran of the U.S.

A type of nonconforming mortgage loan, jumbo loans may require a credit score of 700 or higher. Here’s an example of the potential interest rate gap for a 30-year fixed-rate mortgage based on different credit score ranges. Additional calculations estimate the monthly payment and lifetime interest for a starting loan balance of $320,000. Generally, the less debt you have, the better off you are when you apply for a mortgage. FICO recommends not opening new credit accounts to increase your credit utilization ratio, because each credit request can lower your score slightly.

One of the best ways to prepare for the homebuying process is to check your credit score ahead of time. With a 650 credit score, there shouldn’t be any limit to the type of home that you can get. You’ll likely need to have your home value be under the limits for a jumbo loan. In 2024, that means you’ll want a home loan at or below $766,550 in most areas of the country. As long as you stay under that limit, you should be able to qualify with most different kinds of loan programs.

These quick tips can put you on the right path to raising your credit. See what’s included in your credit report, and make sure it’s accurate. Check to see that all of the accounts are truly your accounts, and that all the balances are current and correctly reflect what you owe. If you see any mistakes, report them to the credit bureau(s) that list the error. Most people are unaware of these complexities and make numerous grave mistakes.

You can go directly to each credit bureau (Equifax, Experian and TransUnion) or myFICO as well, although service fees may apply. Most credit score services retrieve the FICO Score 8, which is a basic appraisal of your credit history. It doesn’t emphasize a particular loan type and serves as a baseline for general lending decisions. Banks may also use a customized, industry-specific credit score when applying for certain consumer loans. With no money down, you’ll have higher monthly payments, potentially a higher interest rate and less chance of approval compared to someone who provides more cash up front. VA loans and USDA loans both offer financing for low- or no-down payment loans.

As an aspiring homeowner, understanding credit scores and their considerations in buying a home can help you ease the entire process. A higher credit score is a sign to the mortgage loan lender that you can comfortably pay your debt in the future, enabling you to easily qualify for the loan, Rocket Mortgage notes. While higher scores guarantee lower interests, you can still get a suitable mortgage with lower scores depending on the lender and loan type you want. It's important to point out lenders are free to set higher minimum credit score requirements than what the loan-backing organizations require. Some lenders may require a minimum score of 660 for conventional loans, or a score of 580 for a VA loan, for example. The minimum credit score you’ll need to buy a house varies by mortgage type.